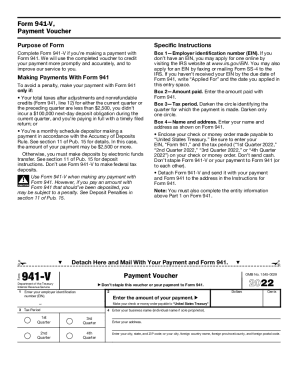

IRS 941-V 2023-2026 free printable template

Instructions and Help about IRS 941-V

How to edit IRS 941-V

How to fill out IRS 941-V

Latest updates to IRS 941-V

All You Need to Know About IRS 941-V

What is IRS 941-V?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 941-V

What should you do if you realize you've made an error after submitting IRS 941-V?

If you've discovered a mistake after filing IRS 941-V, you can correct it by submitting an amended version of the form. Ensure that you clearly mark the amended form as such and specify the corrections made. It's essential to file the amended form as soon as possible to avoid potential penalties.

How can you track the status of your IRS 941-V submission?

To track your IRS 941-V, you can use the IRS's online tools or contact their helpline for updates on your filing status. Be prepared to provide your details and confirm your identity for security purposes. It's important to check for e-file rejection codes if your submission did not go through.

What steps should you take if you receive an IRS notice regarding your 941-V?

Upon receiving an IRS notice concerning your 941-V, carefully read the communication to understand the issue. Gather any necessary documentation to address the notice and respond promptly to avoid further complications. Seeking assistance from a tax professional may also be beneficial.

What are some common errors that filers encounter with IRS 941-V?

Filers often make mistakes such as entering incorrect amounts, failing to include proper identifying information, or overlooking deadlines. To minimize errors, double-check your entries and ensure compliance with all recent IRS guidelines before submitting your form.

See what our users say